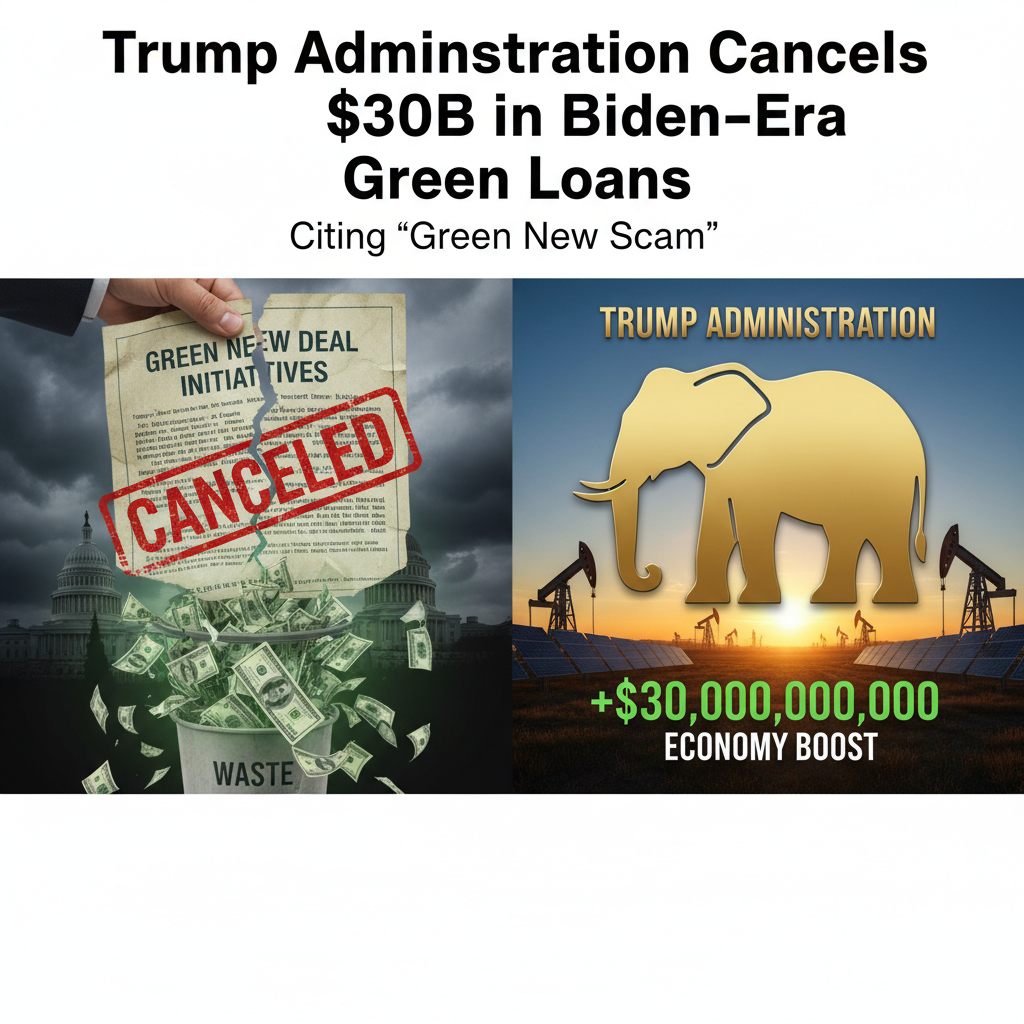

In a move that has ignited debate within the energy sector and across the political spectrum, the Trump administration has canceled approximately $30 billion in green energy loans. The decision, announced by the Energy Department, cited the loans as part of the “Green New Scam.” This action directly reverses policies enacted during the Biden administration and raises significant questions about the future of government funding for green initiatives.

The core of the issue revolves around the interpretation and support of green energy projects. The Biden administration had initiated these loans as part of its broader strategy to promote renewable energy sources and combat climate change. The Trump administration, however, views these initiatives through a different lens, characterizing them as wasteful spending under the guise of environmentalism. This fundamental disagreement highlights the stark contrast in energy policy between the two administrations and the potential for significant shifts in the market based on political decisions.

The cancellation of these loans will likely have a ripple effect across the energy market. Companies that were banking on this funding may face significant challenges, potentially leading to project delays or cancellations. Furthermore, the move sends a clear signal to investors about the risks associated with government-backed green energy projects, which could impact future investment decisions. The “Green New Scam” label, used by the Trump administration, is a strong rhetorical device that could influence public perception and policy discussions surrounding climate change and government spending on green initiatives.

The Energy Department’s announcement did not provide specific details on which projects would be affected or the rationale behind the cancellation of each individual loan. This lack of transparency has drawn criticism from those who support green energy initiatives, who argue that it undermines the stability and predictability needed for long-term investments in renewable energy.

This decision is a clear indication of how quickly energy policy can shift with changes in political leadership. The implications extend beyond just the financial aspects, potentially impacting the trajectory of the renewable energy sector and the broader efforts to address climate change. The move underscores the importance of understanding the political landscape and its potential influence on market dynamics within the energy sector.