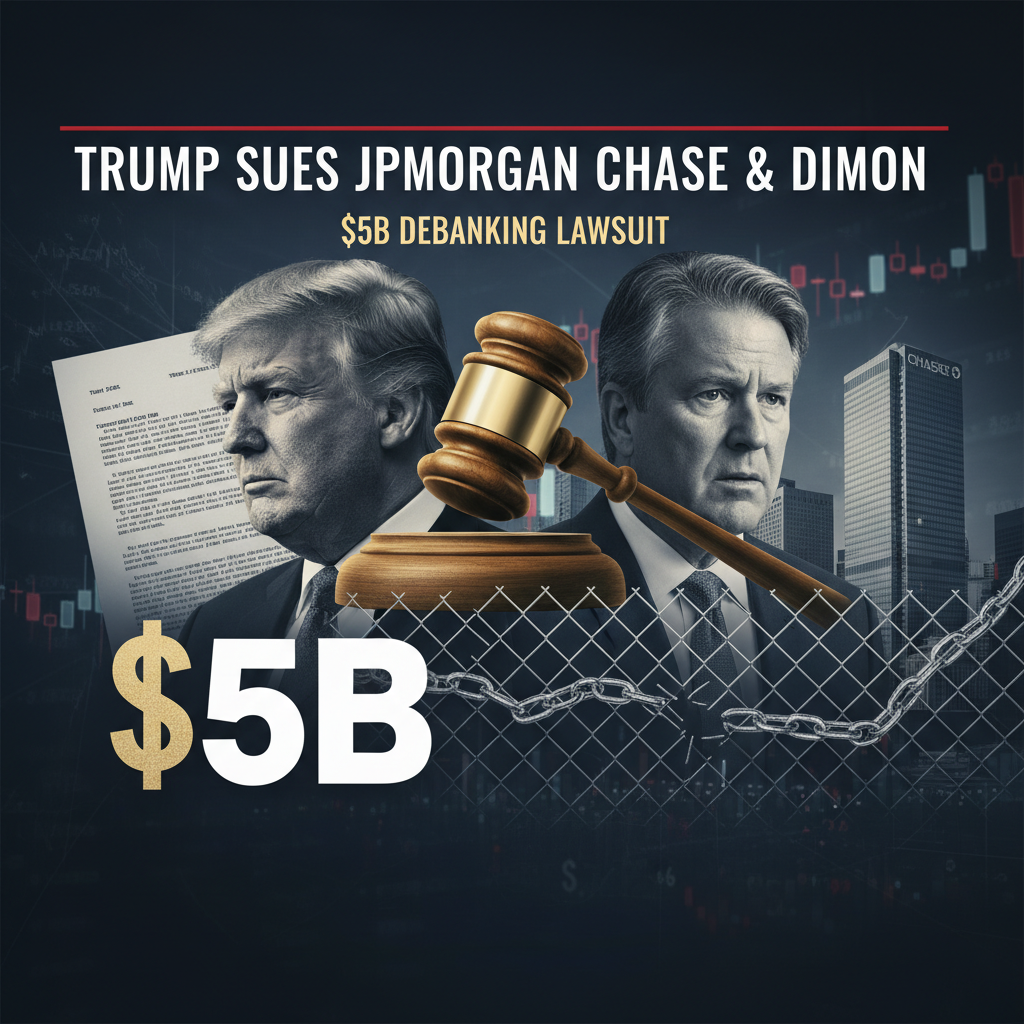

In a move that has sent ripples through the financial and political worlds, former President Donald Trump filed a $5 billion lawsuit on Thursday against JPMorgan Chase and its CEO, Jamie Dimon. The lawsuit accuses the financial institution of debanking Trump for what he alleges were politically motivated reasons. This marks a significant escalation in the ongoing tensions between Trump and major financial institutions.

The core of the lawsuit centers on the claim that JPMorgan Chase unjustly terminated its banking relationship with Trump. The specifics of the debanking, and the reasons behind it, remain a key point of contention. The lawsuit alleges that the decision was driven by political bias, a claim that, if proven, could have wide-ranging implications for the financial industry’s role in politics and the treatment of high-profile individuals.

The lawsuit, filed on Thursday, seeks $5 billion in damages. This substantial figure underscores the seriousness of Trump’s allegations and his determination to pursue the matter. The case is likely to attract considerable media attention and could lead to a protracted legal battle, potentially involving the disclosure of sensitive financial and internal communications.

For JPMorgan Chase and Jamie Dimon, the lawsuit presents a major challenge. The bank, under Dimon’s leadership, has navigated numerous complex legal and regulatory issues. This lawsuit, however, brings a new dimension, potentially exposing the bank to accusations of political discrimination and challenging its reputation for impartiality. The outcome of the case could set a precedent for how financial institutions manage relationships with politically sensitive clients.

The lawsuit’s progress and the arguments presented by both sides will be closely watched by investors, analysts, and the public. The case could influence how financial institutions assess and manage their risk profiles, particularly concerning their relationships with politically active individuals and organizations. It also raises questions about the balance between a financial institution’s right to choose its clients and the potential for political bias.