The whir of machinery filled the air at the Tata Motors plant outside Pune. Engineers hunched over circuit boards, their faces illuminated by the glow of diagnostic screens. It was late 2024, and the team was deep in the throes of testing the thermal management system for the new Nexon EV. This wasn’t just about assembling vehicles; it was about building the future of India’s electric vehicle ecosystem, one meticulously crafted component at a time.

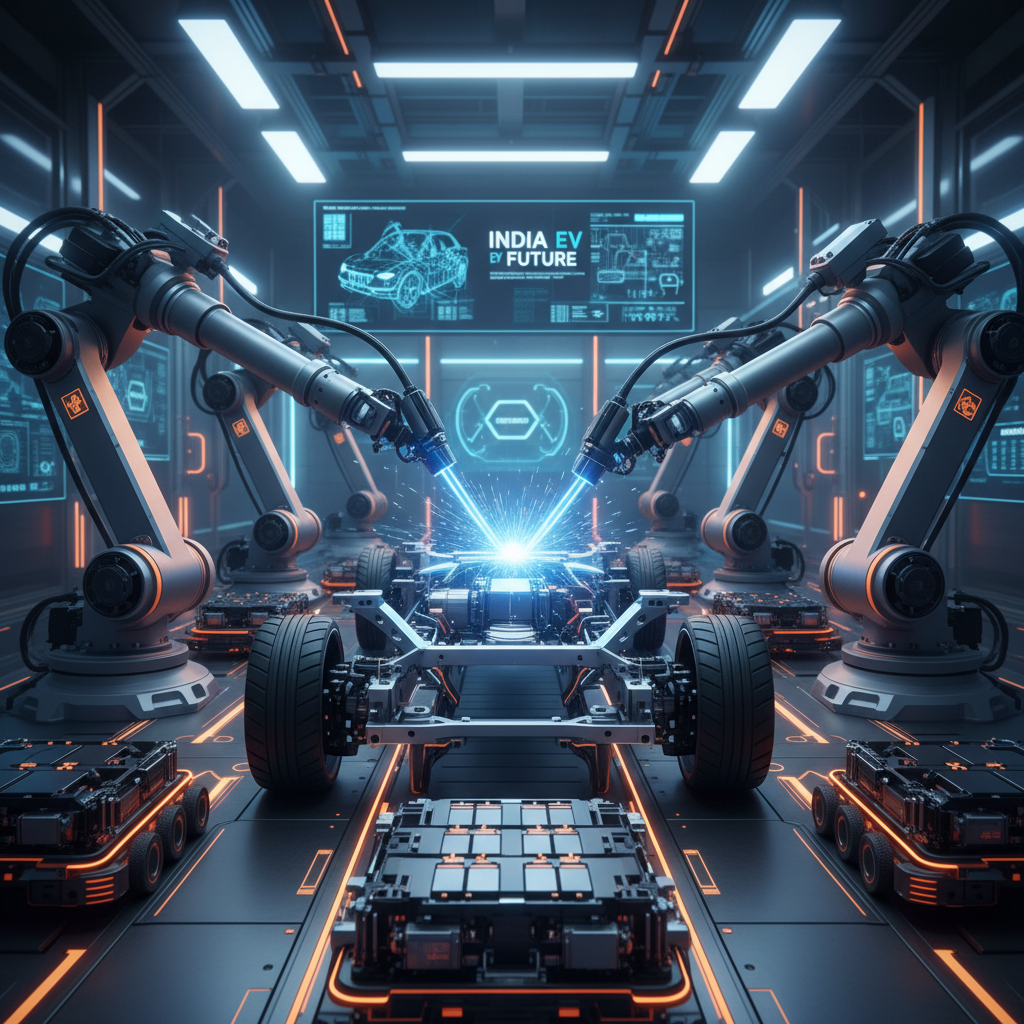

India’s ambition to become a global EV powerhouse is increasingly reliant on precision local manufacturing. The focus has shifted from simply assembling imported parts to developing a robust domestic supply chain, especially for critical components like batteries and advanced electronics. This shift is not just about boosting sales; it’s about fostering innovation and gaining control over the technological core of the industry.

“The next wave of EV innovation in India will be driven by the precision with which we manufacture, not just the speed at which we assemble,” stated Dr. Anoop Bapat, a lead engineer at a prominent EV startup, during a recent industry conference. He emphasized that local production is the key to faster iteration cycles. This means quicker design changes, more tailored solutions for Indian conditions, and ultimately, a more competitive EV market.

The manufacturing landscape is changing rapidly. Companies are investing heavily in local battery production. For example, Ola Electric is constructing a massive gigafactory with a projected capacity of 50 GWh, aiming to start production by late 2025. This, along with other similar projects, is designed to reduce the country’s reliance on imported cells, which currently account for a significant portion of EV costs. The government’s Production Linked Incentive (PLI) scheme is playing a crucial role by providing financial incentives to boost domestic manufacturing.

The challenges, however, are significant. India’s electronics manufacturing ecosystem is still developing, and the country relies heavily on imported semiconductor chips. This is where the push for precision manufacturing becomes even more critical. It’s about squeezing every bit of efficiency and performance out of the components that are available.

Supply chain constraints are a constant concern. “We’re seeing delays in chip deliveries, which is impacting our production timelines,” said a spokesperson from a major EV manufacturer. “We’re working closely with our suppliers to mitigate these issues, but it’s a day-to-day battle.”

Analysts are optimistic about the long-term prospects. A recent report by JMK Research & Analytics projects that the Indian EV market will grow at a CAGR of over 30% between 2023 and 2030. This growth will be fueled by both government initiatives and increasing consumer demand.

The push for local manufacturing also has geopolitical implications. As global tensions rise and supply chains become more fragmented, India is keen to reduce its dependence on any single country for critical components. This strategic imperative is adding another layer of urgency to the push for precision manufacturing.

Back at the Tata Motors plant, the engineers continued their work. The hum of the machinery was a constant reminder of the complex and challenging task ahead. It’s a moment of truth, the intersection of technological advancement and industrial policy.