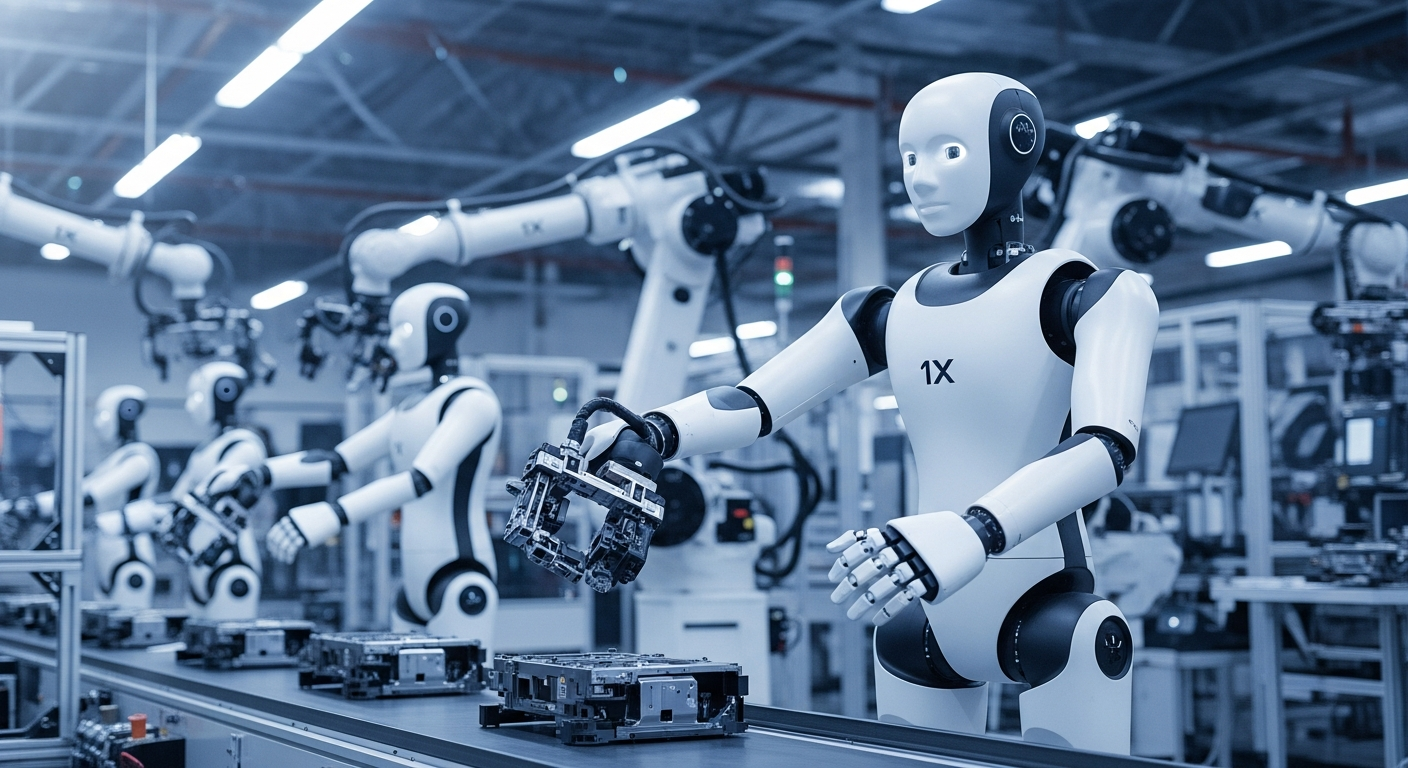

The fluorescent lights of the 1X robotics lab hummed, reflecting off the polished chassis of a NEO robot. It was mid-December 2025, and the team was huddled around a monitor, running thermal tests. The initial vision, a humanoid assistant for the home, seemed to be fading, replaced by a new reality: factories and warehouses. The shift was confirmed on December 11th, when 1X announced a deal to send their NEO robots into industrial use cases.

“It’s a pragmatic move,” noted Kai Jensen, lead robotics analyst at ABI Research. “The economics of home robotics are still uncertain. The industrial sector offers a clearer path to revenue, even if it means a longer, more complex sales cycle.” The move signals a pivot, and perhaps a recognition of the supply-chain and regulatory hurdles facing consumer robotics. The original plan was to have NEO units in homes by early 2026, but the economics of home robotics are still uncertain. The industrial sector offers a clearer path to revenue, even if it means a longer, more complex sales cycle.

The NEO, with its advanced dexterity and human-like form factor, was initially pitched as a domestic helper. Capable of navigating complex environments and performing tasks like tidying up, the robot was designed to integrate seamlessly into a home setting. But the path to market proved challenging, and the competition was intense. The industrial sector, with its demand for automation and its willingness to invest in specialized equipment, presented a more attractive opportunity. 1X is betting on the fact that the capabilities of the NEO, such as its ability to manipulate objects and adapt to changing environments, can be directly applied to tasks like picking and packing, or even operating machinery.

The decision also reflects broader trends in the robotics industry. According to a report from McKinsey, the market for industrial robots is projected to reach $80 billion by 2030. The demand for automation is driven by labor shortages, rising wages, and the need to improve efficiency and safety. 1X is positioning itself to capitalize on these trends. The company is likely looking at an initial deployment of several hundred units in 2026, with plans to scale up production based on demand and performance metrics.

The transition to industrial applications won’t be without challenges. The NEO robots will need to be adapted to the rigors of factory environments, including dust, temperature variations, and the potential for collisions. 1X will also need to navigate the complexities of integrating its robots into existing factory systems and securing contracts. The company will also need to navigate the complexities of integrating its robots into existing factory systems and securing contracts. The company will also need to consider the manufacturing constraints, including chip supplies and export controls. 1X will be competing with established players like Boston Dynamics and ABB, as well as a host of smaller startups. The shift to industrial use cases is a strategic gamble, but it could pay off handsomely if 1X can execute its plan.