Rare Earths Stocks Surge Amidst Intensifying Global Minerals Race

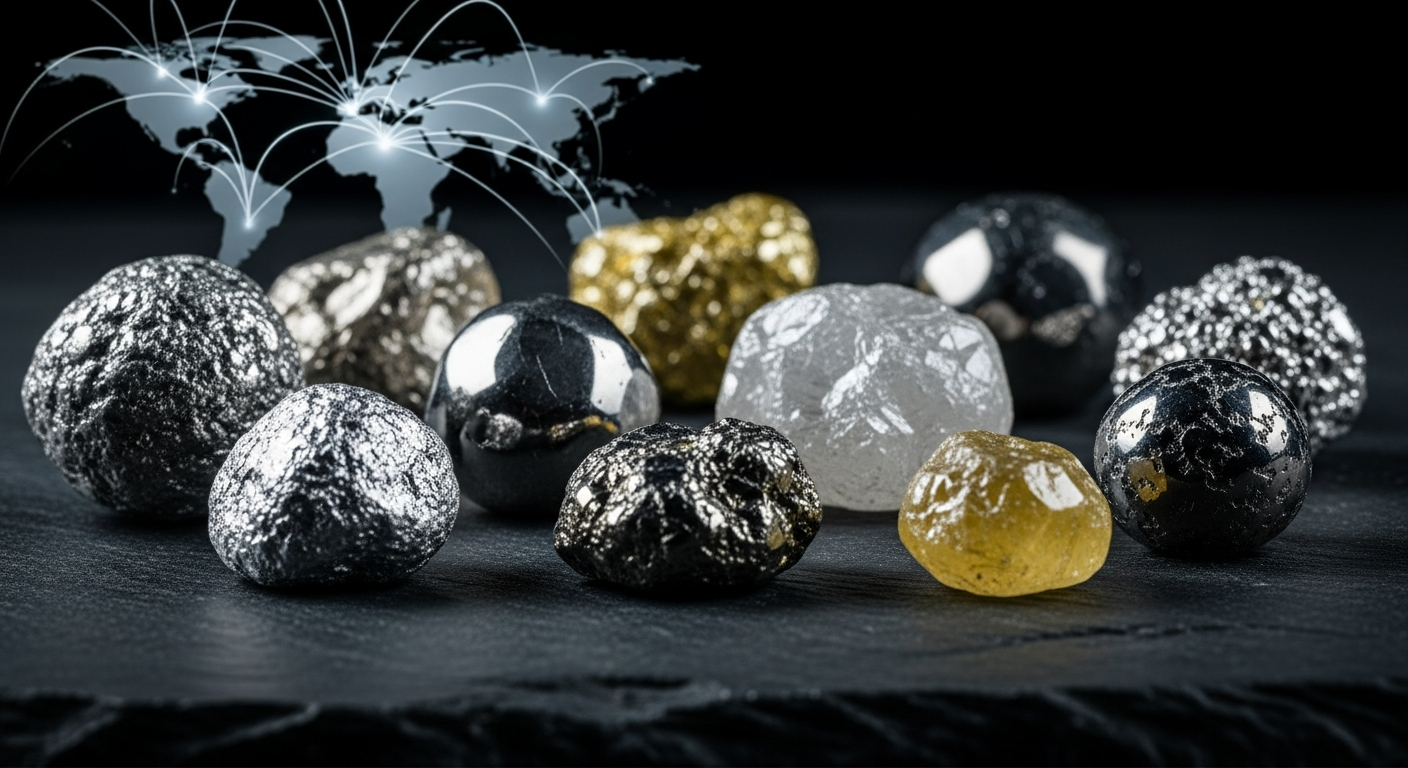

The global race for critical minerals is intensifying, and the stock market is reflecting this trend. Specifically, recent reports highlight a significant surge in the value of rare earths stocks, with U.S.-listed rare earths miners leading the charge. This surge underscores the growing importance of these minerals in the global economy and the strategic implications of their control.

The Rise of Rare Earths

The term “rare earths” encompasses a group of 17 elements crucial for various high-tech applications. These elements are essential in the production of smartphones, electric vehicles, wind turbines, and defense systems. Their increasing demand has led to a boom in the mining sector, particularly for companies involved in the extraction and processing of these vital resources. This year alone, some companies have seen their stocks rally by over 400%, a testament to the market’s enthusiasm and the perceived growth potential.

Who’s Benefiting?

The primary beneficiaries of this trend are the U.S.-listed rare earths miners. These companies are at the forefront of the global critical minerals race, positioning themselves to capitalize on the increasing demand. While the specific names of these companies are not detailed in the provided information, the overall sentiment is positive, indicating a robust investment opportunity within this sector. The growth of these stocks is a direct result of the global critical minerals race, which has been heating up, driving up demand and consequently, stock prices.

Why the Sudden Interest?

The primary driver behind this surge is the intensifying global competition for critical minerals. As nations worldwide recognize the strategic importance of these resources, the race to secure supply chains has become more urgent. This competition is fueled by the need to secure resources for technological advancements, national defense, and the transition to a greener economy. The market’s positive response reflects the expectation that these miners will play a crucial role in meeting the world’s growing needs.

Looking Ahead

The trajectory of rare earths stocks will likely continue to be influenced by geopolitical dynamics, technological advancements, and the pace of the global energy transition. As demand for these materials grows, investors are closely watching the strategies of U.S.-listed rare earths miners and the broader market trends that will shape the future of this critical industry. The current boom is not just a market fluctuation; it is a reflection of a fundamental shift in the global economic landscape.

Conclusion

In conclusion, the surge in rare earths stocks highlights the growing importance of critical minerals in the modern economy. With the global critical minerals race accelerating, the prospects for U.S.-listed rare earths miners look promising. The performance of these stocks this year underscores the potential for continued growth and the strategic value of these resources.